Global Economy and the Financial System on the Cliff’s Edge?

11 MarThe illusion of economic stability convinced most people that the great economic crisis of 2008 was exceeded. The truth is that it’s just beginning, and the next wave of crisis is very close. Europe is experiencing economic depression and is only a matter of time before the U.S. will follow.

Unemployment rate at high alert

Published last Friday, this index shows a new historic high in the euro area unemployment rate: 11.9%. In Italy it rose to peak last 21 years, while in Greece reached 27%. More worrying is the unemployment rate among young people under 25 years: in Greece and Spain is close to 60% and in Italy and Portugal is 40%.

Published last Friday, this index shows a new historic high in the euro area unemployment rate: 11.9%. In Italy it rose to peak last 21 years, while in Greece reached 27%. More worrying is the unemployment rate among young people under 25 years: in Greece and Spain is close to 60% and in Italy and Portugal is 40%.

Jobs crisis is a direct consequence of the global crisis of 2008 and may generate a political crisis. In general for each unemployed person three people have to suffer. For the euro area the real test is not the debt crisis, but how to avoid the consequences of high unemployment.

Continue reading

Unemployment rate falls to lowest level since 2008

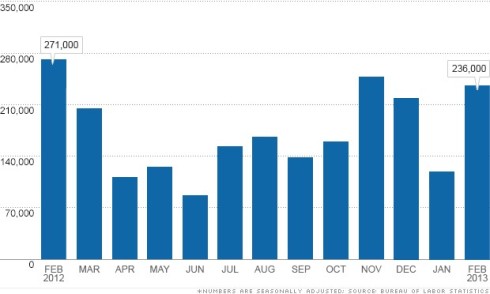

8 MarU.S. employers ramped up their hiring in February, helping the unemployment rate to fall to its lowest level since December 2008.

The U.S. economy added 236,000 jobs in February, according to a Labor Department report released Friday. That’s much stronger growth than in January, when employers hired a revised 119,000 workers.

The unemployment rate fell to 7.7% last month, the lowest since December 2008, from 7.9% in January, figures showed.

Employment increased in professional and business services, construction and health care.

Employment growth has risen by an average of 195,000 a month in the last three months, figures show. Analysts had forecast a rise of 165,000 jobs for February.

Professional and business services added 73,000 jobs last month, while the construction industry hired 48,000 employees. The health care industry added 32,000 jobs and the retail sector added 24,000 new staff.

Following the release of the jobs figures, stocks on Wall Street opened higher with the Dow Jones index up 62.23 points at 14,391.72 . The dollar also gained against the euro and the yen.

Historic day, Dow surges to record highs

5 MarService sector grows at fastest pace in a year

The pace of growth in the vast U.S. services sector accelerated to its fastest pace in a year in February, helped by a rise in new orders and demand for exports, an industry report showed on Tuesday.

The Institute for Supply Management said its services index rose to 56 from 55.2 in January, exceeding economists’ forecasts for 55. It was the highest level since February 2012.

A reading above 50 indicates expansion in the sector.

The new orders index jumped to 58.2 from 54.4, while orders for exports rose to their highest level since May 2007 with that gauge at 60.5, up from January’s 55.5.

After hitting an intraday record at the open on Tuesday, the Dow Jones Industrial Average extended gains after the service sector data.

If the Dow ends the day at these levels, it will also set a new record closing high, above 2007’s 14,164.53.

Shortly after the opening bell, the Dow rose above 14,198.10, the intraday all-time high reached in October 2007, when the world was heading toward the financial crisis.

Analysts said Tuesday’s advance was due less to one specific catalyst and more to the same factors that have been driving the rally this year, namely attractive valuations and liquidity from loose monetary policy around the world.

The Dow Jones industrial average was up 129.77 points, or 0.92 percent, at 14,257.59. The Standard & Poor’s 500 Index was up 13.72 points, or 0.90 percent, at 1,538.92. The Nasdaq Composite Index was up 33.12 points, or 1.04 percent, at 3,215.15.

Stock Market Likely to Crash From Here

1 MarTriple Top?

The S&P 500 and Dow Jones are both once again near all-time highs…for the third time. The old saying third time’s a charm can work both ways when it comes to the stock market. Sometimes an index will bust through to new highs, and other times it will fail spectacularly crashing to new lows.

We should all be watching the behavior of the major indexes here, because the possibility of a major triple-top failure is quite high, for reasons outlined below.

If the S&P 500 fails at the triple top and breaks down, from a charting perspective the next thing for it to do is revisit the bottom and then make up its mind as to what it wants to do next. The implication here is that a major failure of the S&P 500 will open the possibility of it revisiting the 600-800 level, or some 45% to 60% lower from the 1,500 level where it currently churns.

It will take some time to get to that level, typically 3-6 months, unless there’s some sort of financial accident to hasten things along, in which case it could all be over in a month or two.